In today’s fast-paced lending market, credit businesses constantly seek ways to optimize operations, streamline processes, and enhance profitability. One crucial area that demands attention is loan management.

Traditional manual processes are time-consuming, error-prone, and hinder efficient decision-making. But in comes automation—one of the most intelligible means to gain a competitive advantage, lower cost, and scale a lending business rapidly.

Online loan management systems empower credit businesses to maximise their return on investment (ROI) and revolutionise the lending experience. In this blog post, we will explore the key benefits of leveraging an online loan management system and how it can unlock the full potential of your business’s lending activities.

Key Benefits of Automated Loan Management Systems

Let’s dive into the benefits of using software for loan management to maximise ROI.

1. Enhanced efficiency and streamlined workflows

With an online loan management system, you can forget about manual paperwork and repetitive tasks. The system allows you to automate loan origination, document verification, underwriting, and disbursement processes. Your loan officers and other staff can now focus on high-value tasks like customer engagement and relationship building.

Automating repetitive tasks eliminates bottlenecks and reduces turnaround times, helping you increase the number of loans processed, resulting in a higher ROI.

2. Quicker onboarding process

If you’re using a reliable modern loan servicing software such as Presta LMS, it will take you between a few hours to a few days to onboard your customers. This lets you quickly and easily begin managing your customers’ loans immediately.

3. Reduces costs and increases profitability

The cost of a robust loan management solution may seem significant; however, the best loan management software is a powerful force multiplier that brings a substantial return on investment by helping reduce the long-term cost of operation.

For instance, rather than hiring additional staff to process a higher volume of loan applications, the loan software for lenders will automate manual tasks, which still results in a higher volume of loans and more profits without increasing headcount.

4. Improved risk management and compliance

Your bottom line is not only affected by the number of loans you’re able to process but also by your ability to maintain risk control and compliance. Online loan management systems come with dedicated risk assessment tools, credit scoring algorithms, and fraud detection mechanisms that enable you to make informed lending decisions. This lets you minimise the risk of defaults and ensure compliance with regulatory requirements. By effectively managing risk, you can protect your investments and generate a more substantial ROI over the long term.

5. Enhanced customer experience

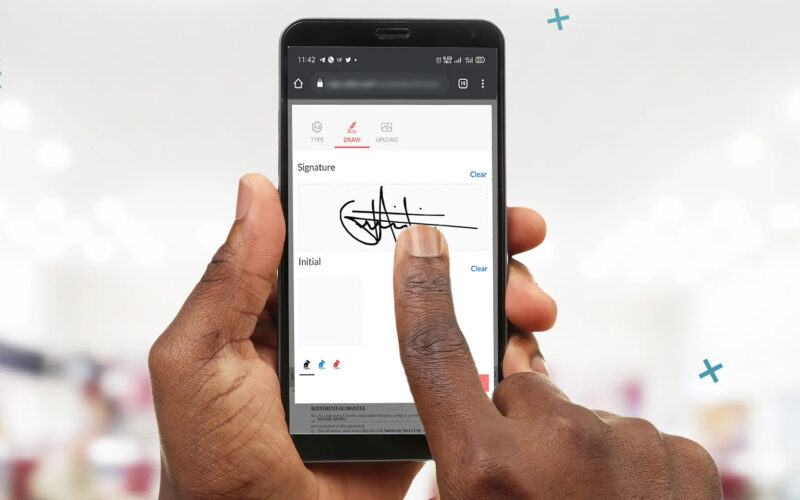

In today’s digital age, borrowers expect seamless and convenient lending experiences. An online loan management system enables you to provide just that. Borrowers can conveniently apply for loans, get guarantors to sign loan forms online, track application status, and access funds through payment platforms of their choice. By delivering a superior customer experience, you increase customer satisfaction and foster customer loyalty, leading to repeat business and referrals.

6. Scalability and flexibility

Growth is every organization’s goal. But sometimes, growth can be problematic if your systems are not growing with you. The bigger your loan portfolio grows, the more your loan management needs will evolve, and an Excel sheet or Quickbooks loan manager won’t cut it anymore.

Online loan management systems are flexible and scalable and will adapt to changing business requirements. Whether you’re expanding into new markets, launching new loan products, or integrating with third-party services, the loan servicing software can seamlessly accommodate these changes. Leveraging a scalable solution allows your lending operations to keep pace with your business growth, thus maximizing your ROI potential.

Supercharge Your Growth with Presta Loan Management System

An online loan management system is no longer just a luxury; it’s a necessity for credit businesses looking to maximize their ROI. At its core, loan management software minimises manual tasks and automates repetitive actions propelling your organization toward greater profitability and success.

Here at Presta Africa, we take great pride in providing robust loan management solutions that can help you streamline your entire process of originating, underwriting, disbursing, and servicing loans.

We also have a phenomenal team of dedicated professionals who work tirelessly to ensure you’re onboarded quickly so you can start using our software immediately.

Still got questions about the benefits of our online loan management system? Contact us now to learn more about how Presta LMS can help maximise ROI and grow your business!